To Salary or not to Salary?

For most entrepreneurs, myself included, the aspiration behind starting a business is the freedom to live your life on your terms, rather than clocking-in and clocking-out everyday for 30-50 years. It’s an admirable goal - the American Dream by many standards - but at the end of the day everybody needs a paycheck to put food on the table.

In this article I analyze how much should you pay yourself, what makes projects worth your time, and how to consistently grow your business through a thoughtful investing template.

To Salary or not to Salary?

Everybody has a choice when they receive a paycheck: how much do I spend and how much do I put aside in savings? This first part is different for everyone but I like to think about it as a “Consumption level” - or “how much cash do I need each year to maintain the lifestyle that I am comfortable with?” Keep that consumption level concept in mind but let’s briefly hit on my favorite part Savings!

Saving IS Investing

For the savings people put aside, there’s always a good reason like saving for:

An emergency like losing your income, a health issue, or a leaky pipe

Large life events like a buying a house, having a kid, or retirement

A special occasion like a vacation

There’s a few choices with what to do with these savings:

Hold it in Cash - A little flavorless compared to the other options but often ideal for needs within the next 1-3 years given the stable value.

Side note: Even though inflation has been relatively high the past couple of years, cash is still the most liquid form of savings since it’s the only one you can spend!

Make Investments - Investments are a form of turning your extra savings (plus some patience!) into income down the road. This comes in a lot of forms: it could be buying a property, investing in a small business, or buying stocks and bonds. Depending on the investment, this is best for spending needs in more than 3 years. Bonds and lending money are also investments, which means buying your own debt is also an investment!

Pay down Debt - I like to say “buying your own debt” as a bit of a joke, but it’s true: when you pay down debt you are choosing, adjusted for the risk, that you're getting a guaranteed return equal to the interest rate on the debt. For example, if you have debt at a 7% interest rate, paying it off is like making an investment that gives you a guaranteed 7% return. Not too bad!

Small Business Owners as Investors

For Owner-Operators, like the clients I work with, there’s a unique investment opportunity that most normal people don’t have access to - Private Equity.

I know, I know, your thinking: Duncan isn’t Private Equity, just a bunch of Ivy League dudes in vests moving around money for rich people?

And my response is… Well, you’re not totally wrong… BUT the way you invest as a business owner that is in the same way they do it - YOU put your savings into the equity of a private company! That’s right you’ve been doing PE all along (sleepless nights of a Wall Street analyst included…) Private Equity investors look at a company as an asset, similar to a stock or a bond, but with a much more complex system behind it.

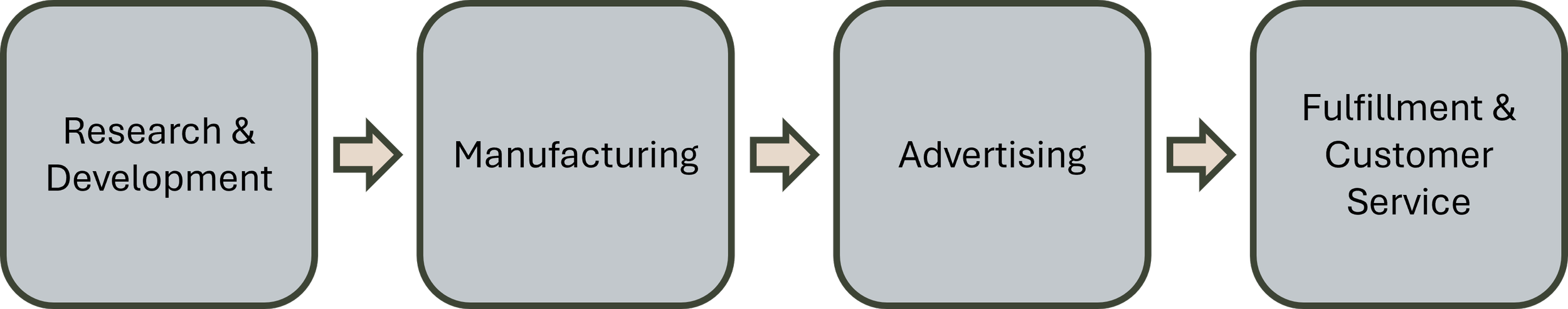

When I’m working with my clients, we first think about how they want to live their life. Once we establish the type of work they want to be doing, we can take a step back from the business and also think about the company as a complex system. This allows us to diagram out their current role in the business and start to think about:

What are the Core Competencies of the operator and also the business?

Which non-core areas can be hired internally or outsourced all together?

What investments can we make to expand the Core Competencies?

How much to pay yourself?

Spoiler Alert! The amount you should pay yourself is your Consumption Level (CL). However, this needs to be separated out into Minimum CL and Desired CL:

Minimum CL: You have money to feel comfortable while being frugal to creating savings for investment.

Desired CL: You have money to be at the ideal level of comfort for you and your family.

Once you have these figures, we can use some trusty math:

Desired CL / Desired hours of work = Golden Rate

Minimum CL / Acceptable hours of work = Minimum Rate

These equations, while simple, gives us a framework for how much we are targeting to pay you, the Golden Rate, as an input to judge potential investments in the business. The minimum rate allows us to analyze investments that are worth your time and being thoughtful about the sweat equity that goes into the returns on investment.

Making Investments to Increase Income

Going back to our discussion about business as a complex system, we can now start thinking about the projects that we can invest into to increase your hourly pay to the Golden rate. When working with clients, this is where we begin diving into the operations and data to build a deep understanding of the business to build a shopping list of opportunities.

Shopping list in hand, we can model each project opportunity as its own investment; looking at the additional revenue/reduced expenses, CapEx, operating expenses, and labor costs (using the minimum rate for your hours). After thinking through the capital outlay and risks, we come up with a compound rate of return on each of the projects, aka an “Internal Rate of Return", or IRR. We now execute each project in order of highest risk-adjusted IRR first.

A great example of a the #1 project with one of my clients was a tooling investment to launch a new product. After questioning our assumptions and judging the risks, we estimated the IRR to be above 25% over the next three years . This meant that for every $1,000 invested into the project, we were expecting a $1,953 in return over the next 3 years, or a 95% cash-on-cash return.

From here, we repeat the cycle using savings to make good investments and increase the company’s income. Each time increasing the income savings of the business until the company’s income plus your salary exceeds the Desired CL at your desired level of hours in the business.

Side Note: As the desired hours of work approaches zero, then the golden rate would exponentially approach to infinity. At this point, we steadily replace your least enjoyable roles in each project with the cost of an employee. The logical conclusion is eventually hiring a CEO to manage everything on your behalf!

Cash is KEY

A key input into this compounding investment engine is having the cash to execute on these opportunities. That could mean saving the cash in the business by paying yourself the minimum rate for longer and/or, particularly if it would take to long to save for, taking outside investment!

When to take Outside Investment

My rule of thumb on outside investment is to look at the duration and risk of the opportunity and then find matching investors while thinking about the cashflow dynamics and “cost of capital”, or interest rate, in the context of the larger business.

Always raise debt before equity if possible. The cost of capital for debt is anywhere from 7-12%+ so it shouldn’t be a consideration unless the return on the project is modest (10-15%+) and the timeline to self-finance is too long.

Personally I don’t think outside equity makes much sense until we start looking at projects well above a 20% return, and even then its important to put that in the context of the larger business and structure the equity in a way that shares the reward without giving up the kingdom.

I’ll plan to write a more in depth article on Debt, Equity, and the Capital Stack in the coming months.

To Salary or Not to Salary?

After reading this article, I hope you agree that there isn’t a simple answer to this question. It’s nuanced based on your lifestyle, risk tolerance, and business opportunities. Savings are an important consideration when thinking about salary particularly if you are looking to continue to grow the business and your earning potential. In summary, if you are looking at the profits each quarter, make sure you cover your minimum lifestyle first and make an active decision with the remainder to determine if you prefer to live a nicer lifestyle in the short-term or continue to push towards your long-term goals!

If you enjoyed this article, please consider subscribing to my newsletter!